Why Choose Financing with Tally Food Equipment?

Explore our financing options and apply today!

Quick and easy access to financing.

Customized options for every budget and need.

Begin with an easy payment plan and let us assist you along the way!

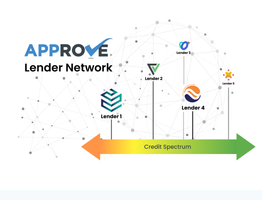

Flexible Plans with Trusted Partners

FAQs

Our Location

Come to visit us, we are always glad to serve our customers!

630 Capital Cir NE Suite 2, Tallahassee, FL 32301

Cómo llegarMonday thru Friday 8:00 AM – 6:00 PM

Saturday 9:00 AM – 2:00 PM